Key Takeaways:

- Carbon credits are a viable way forward to supplement green energy investment rather than relying on government subsidies to outfit large scale green energy projects.

- They can be traded or retired by a company to offset Scope 1, Scope 2, and Scope 3 emissions.

- The Voluntary Carbon Market clocked a notable $1 billion in transactions in 2021.

The boiling concerns on climate change have made renewable energy sources and their development take a priority place in an unending line of possible solutions to clean energy.

Companies leading the clean energy transition have been, or are seriously considering, leveraging the carbon credit markets to offset an investment into more sustainable energy programs. Carbon credits are a viable way forward to supplement green energy investment rather than relying on government subsidies to outfit large scale green energy projects.

What does the current carbon market boom mean to startups that develop renewable energy projects? How should venture capitalists and impact investors assess them? How do carbon credits impact the development of renewable energy projects such as solar and wind farms?

Let’s first explain what a carbon credit is and its role in energy transition.

Understanding Carbon Credits

Carbon credits are a transferable instrument that can be traded or retired by a company to offset Scope 1, Scope 2, and Scope 3 emissions.

The Difference Between Carbon Credits and Renewable Energy Certificates (RECs)

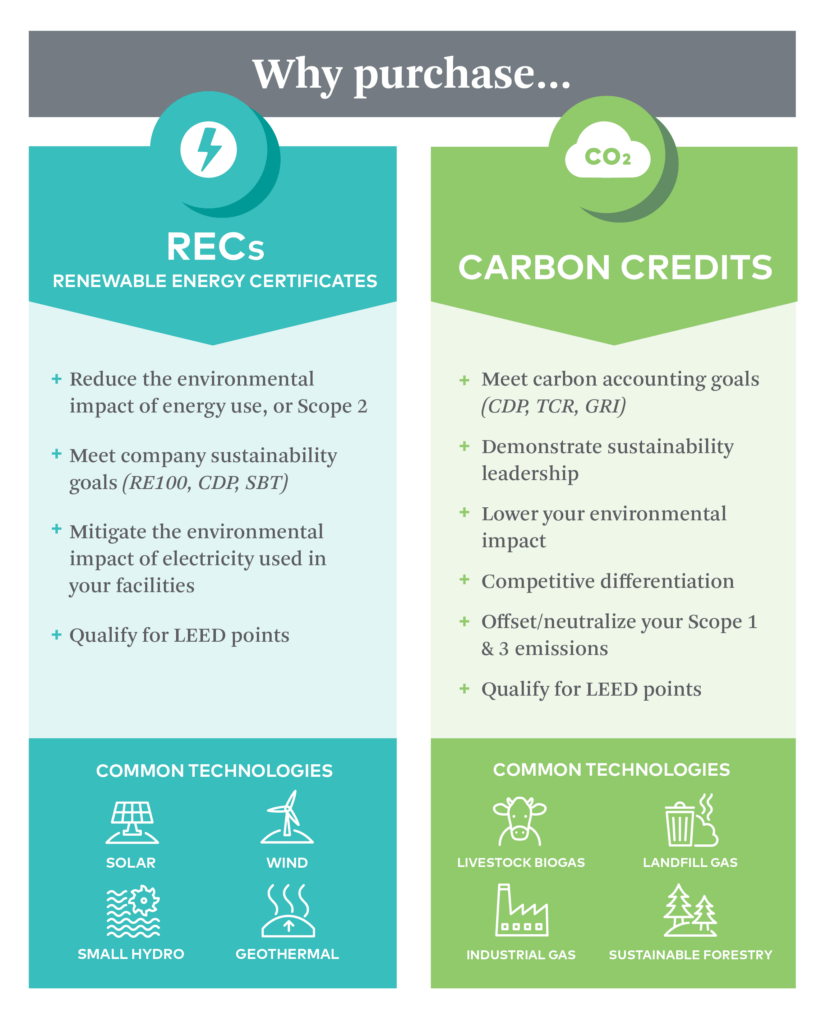

Carbon credits are produced by actions, ventures, or initiatives that prevent, diminish, or eliminate CO2 emissions. These are different from Renewable Energy Certificates. Carbon credits are tradable certificates or permits that give companies, industries, or countries the right to emit 1 tonne (1,000kg) of CO2. RECs are certified proof that energy was created from renewable resources rather than from fossil fuels.

These projects result in fewer carbon emissions being released into the atmosphere compared to what would occur under a “business-as-usual” scenario, from India’s achievement of over 40% renewable powered energy to carbon credits from emissions trading driving the growth of China’s wind farms. Renewable energy credits are a common type of carbon credit these projects generate.

While each type of credit may target different specific climate goals, they all aim to achieve the same overarching objective – to replace non renewable energy sources (petroleum, hydrocarbon gas liquids, natural gas, coal, and nuclear energy) with more sustainable, cleaner, and greener alternatives.

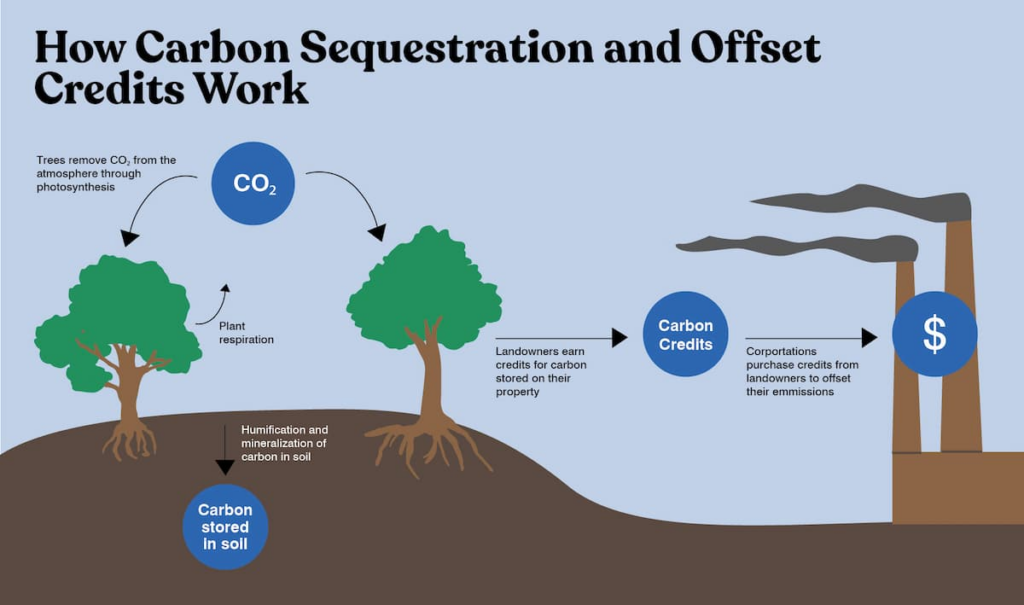

The remaining credits are associated with carbon sequestration projects, which include nature-based solutions like reforestation and technological interventions like direct air capture for CO2 removal.

Carbon Credits and Renewable Energy Development

The perilous state of our global climate, exacerbated by the excessive use of fossil fuels, calls for immediate intervention. The escalating temperatures pose a significant risk to both human life and productivity, necessitating the implementation of environmental policies to foster the global growth of renewable energy.

Mitigating these changes by supplementing with green energy is currently voluntary but will soon become regulated by mandatory renewable energy targets. These policies encompass a variety of measures, including carbon taxation, carbon emissions trading, and governmental subsidies.

Carbon emissions trading, in particular, has been identified as a critical tool in the battle against climate change, utilizing carbon credits as key market mechanisms.

Industry Demand is Soaring:

Analyses from the industry suggest a looming surge in the demand for carbon credits, largely fueled by corporate commitments to reach net-zero emissions. The climate pledges of large corporations are expected to stimulate the trade of carbon credits in the Voluntary Carbon Market (VCM).

In 2022, over a third of the world’s largest publicly traded companies announced their strategies to reduce carbon emissions. These companies buy carbon credits to compensate for the CO2 emissions they can’t yet eliminate or reduce, in conjunction with direct CO2 reduction efforts.

The VCM clocked a notable $1 billion in transactions in 2021. Future predictions indicate that the demand for voluntary credits could escalate to as much as two gigatons per year of CO2 reduction and removal. [Sources: McKinsey, BCG, Morgan Stanley, IEF, BNEF, Forbes, CSIS, UNFCCC)

The Voluntary Carbon Market and Solar

The Voluntary Carbon Market (VCM) plays a significant role in encouraging the adoption of renewable energy sources like solar power. This is primarily due to the increasing demand for carbon credits from corporations aiming to achieve net-zero emissions, which in turn incentivizes the development of projects that reduce or offset CO2 emissions, including solar power installations.

Solar and wind energy are key components in many scenarios for reducing CO2 emissions. Countries that have implemented carbon pricing have been seen to adopt more solar and wind energy. These renewable energy sources not only help reduce carbon emissions but also generate carbon credits that can be traded in the VCM.

The Pros and Cons of Carbon Credits in Renewable Energy Development

While carbon credits are poised to play a potentially crucial role in the development of renewable energy, the solution is not clear cut. These are some immediate advantages and still foreseen challenges.

Pros

Incentivizes Investment in Renewable Energy

Carbon credits provide financial incentives for companies to invest in renewable energy projects. By generating carbon credits through renewable energy projects, businesses can offset their emissions and potentially sell excess credits for profit.

Promotes Emission Reduction

The trading of carbon credits creates a financial motivation for companies to reduce their greenhouse gas emissions. This encourages industries to innovate and adopt cleaner technologies.

Supports Renewable Energy Projects

Renewable Energy Credits (RECs) allow consumers to claim that their electricity usage is sourced from renewable resources with low or zero-carbon emissions. This demand supports the development of more renewable energy projects.

Contributes to Sustainable Development

Many renewable energy projects not only reduce emissions but also create jobs, improve energy access for communities, and foster sustainable development.

Cons

May Enable Continued Emissions

Critics argue that carbon offsets may permit emitters to continue releasing greenhouse gases rather than encouraging them to reduce their own emissions directly. Using carbon credits needs to be in conjunction with a plan to eliminate them and should only mitigate impact short term during this process.

Potential for ‘Flawed’ Estimations

There are concerns about the accuracy of carbon credit calculations, with some critics suggesting that they may overestimate or underestimate actual emission reductions6.

Limited Scope

While carbon credits can incentivize investment in renewable energy, they are often just one piece of a broader sustainability strategy. Companies also need to make operational changes, such as improving energy efficiency.

Navigating the Future of Renewable Energy

The carbon market is driving solar, wind, and hybrid energy adoption by making it financially attractive for companies to invest in renewable energy projects that generate carbon credits. This, coupled with community initiatives and decreasing costs, is accelerating the shift towards green energy like never before.

Contact Greentech United, an integrated ecosystem of energy brokers, suppliers, and managed logistics that will handle your end-to-end renewable energy solutions.