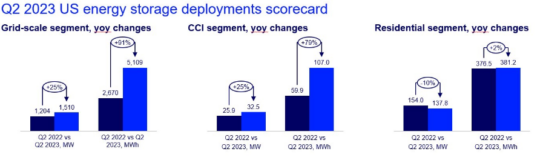

In an unprecedented leap, the U.S. energy storage sector has set a new record in the second quarter of 2023, hitting a high of 1.7 GW / 5.6 GWh. This remarkable achievement underscores the rapid expansion and potential of the energy storage industry in the country.

According to Wood Mackenzie, the U.S. market is projected to install a staggering 66 GW of storage between 2023 and 2027, with 83% of this growth expected at the grid scale. This surge in energy storage capacity is not only a testament to technological advancements but also a reflection of the nation’s concerted efforts toward sustainable and efficient energy solutions.

Wood Mackenzie’s Q3 2023 Energy Storage Market Report

In its Q3 2023 report, Wood Mackenzie highlighted an unparalleled surge in the U.S. energy storage market. The country set a new record in Q2 2023, deploying a staggering 1,680 MW / 5,597 MWh of energy storage across the nation. This impressive development points to an average duration of 3.3 hours, indicating the robust growth and potential of the energy storage sector in the U.S.

Big Record, Fewer Installations

Although the second quarter set a new record, the actual installations were notably less than what was anticipated from project pipelines. Wood Mackenzie noted that projects exceeding 2 GW have been deferred to subsequent years. This divergence between expectations and reality underscores the challenges and uncertainties in the energy storage sector.

Residential Storage Decline

Similar to the residential solar industry, the residential energy storage sector has endured significant challenges this year due to rising interest rates and adverse policy shifts, notably the implementation of California’s Net Energy Metering (NEM) 3.0.

The second quarter witnessed a downturn in residential storage to 138 MW / 381 MWh. The steepest decline was observed in California, where figures fell by 17% quarter-over-quarter and 37% year-over-year. This slump is surprising given the assurances from regulators and utilities that NEM 3.0 would be advantageous for the solar-plus-batteries market.

Pricing

As for pricing, Wood Mackenzie said lithium-ion battery storage systems may have peaked in late 2022. Batteries have come down in price more rapidly than commodity prices since then, though price decreases may start to slow in Q3 and Q4 of 2023, said the report.

According to the report, labor and balance of plant costs are still increasing due to various factors, and transformer and inverter costs continue to trend upward due to high demand. Price pressures are affecting original equipment manufacturers and, to a lesser extent, integrators, and engineering, procurement, and construction (EPC) firms have the most power to pass on costs and be selective with their client choices. (PV Magazine)

Predicted Growth

Despite facing hurdles, Wood Mackenzie anticipates a promising future for the residential storage sector. According to their report, the sector is projected to install 3.5 times more solar in 2027 than in 2023, expecting 8.0 GW over the next five years.

In the foreseeable future, grid-scale storage will constitute the majority of added capacity through 2027. Nevertheless, residential storage is forecasted to overcome recent obstacles and continue to show resilience. The report estimates that between 2023 and 2027, 66 GW of energy storage will be added, with grid-scale capacity making up a substantial 83% of this total.

Five Year Outlook

The Wood Mackenzie five-year forecast for all sectors has been reduced by an average of around 12%, with the majority of these reductions taking place in 2023 and 2024.

The residential storage sector suffered from regulatory obstacles in the short term, while supply issues curtailed near-term projections across all sectors.

Grid-scale storage continues to be hindered by delays in the grid operator interconnection queue. Inefficient processes for grid operator interconnections persist as one of the most substantial hurdles to the United States’ transition towards carbon-free electricity generation and storage.

Worldwide Solar Momentum

The solar industry is witnessing an unprecedented acceleration across all regions globally. In 2023 alone, we anticipate solar photovoltaic (PV) installations to reach a record-breaking nearly 270 GWdc worldwide. This momentum is not slated to slow down; instead, it is projected to escalate further with an annual 330 GWdc by 2032.

This rapid expansion is fueled by several key factors, such as advancements in solar technology, increasing awareness about renewable energy, governmental policies favoring clean energy, and the declining costs of solar installations. Furthermore, innovative practices like agrivoltaics – combining agricultural production with solar energy – are emerging as potential game-changers in the field, contributing significantly to this solar buildout.

These are the main drivers behind worldwide solar expansion:

- ambitious renewable energy targets

- increased electrification

- coal plant phaseouts

- energy security concerns

- expanding policy support

Let Greentech United take you out of the dark with innovative solar solutions.